The crux of our methodology is a unique performance measurement called Cash Flow Internal Rate of Return (CFIRR). CFIRR addresses many of the shortcomings of traditional performance measurements such as Return on Equity (ROE), Return on Assets (ROA) and Return on Invested Capital (ROIC). In principle, CFIRR measures the return on capital but has distinct advantages over traditional return on capital measures. Interestingly, the acronym RoC in our monthly "The RoC Report" stands for Return on Capital and was developed as a marketing term that was simpler and more effective than "The CFIRR Report." In our own reports, the term "return on capital," or simply the term "return," is used interchangeably with CFIRR. However, in studying the details of the methodology it is important to make the distinction between CFIRR and traditional return on capital measures.

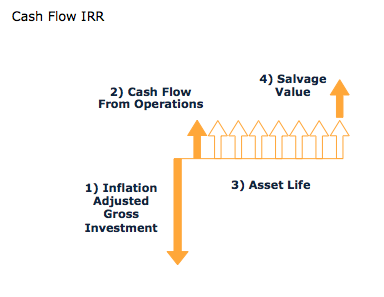

CFIRR should be viewed in context of capital growth and the cost of capital. We will discuss this further after we discuss how we calculate CFIRR.

Calculating Cash Flow IRR

To calculate Cash Flow IRR, there are four separate components:

1) Inflation Adjusted Gross Capital

2) Cash Flow from Operations

3) Asset Life

4) Salvage Value

1) Inflation Adjusted Gross Capital

The first step in calculating CFIRR is to determine the invested capital component. Conceptually, invested capital is long-term debt + equity = assets – working capital. This definition is sufficient when conceptualizing a company's invested capital, however, there are other details to note. Finance textbooks show two methods of calculating invested capital:

A) Asset Approach =

+ Short-Term Assets

- Short-Term Liabilities (excluding short-term debt)

+ Net Property, Plant and Equipment

+ Other Long-Term Assets

+ Intangibles

B) Financing Approach =

+ Common Equity

+ Preferred Stock

+ Minority Interest

+ Deferred Income Taxes

+ Long-Term Debt

+ Other Long-Term Liabilities

+Short-Term Debt

These two methods will always reconcile.

There are two distinct adjustments that are made to invested capital to calculate CFIRR compared to traditional definitions of invested capital.

i) The first adjustment to invested capital is to use GROSS investment - not the NET investment. In other words, accumulated depreciation is added back to the net investment to get gross investment. This is done to calculate the return on total capital contributed to the business. The following example illustrates this application.

Suppose a landowner was considering building condos to be rented by the public. The landowner would determine how much up front capital would be required to build the building. Then the landowner would estimate rates, including rental and occupancy, to estimate the total cash flow going forward. He would then make a determination on whether or not to build based on the expected internal rate of return. Suppose 10 years down the road the landowner wanted to determine if the decision to build had been favourable. In post-mortem analysis, the landowner would look at actual rental rates and occupancy to calculate cash flow, and would still want to know the amount of his original investment, or gross investment. He would not ask his accountant how much the building had depreciated to calculate the return. It is not relevant. In capital budgeting projects managers and analysts estimate the return on gross investment. The return on gross investment is estimated in every finance situation. It follows that the same should be done for publicly traded companies. It is worth noting at this point that gross investment is used to determine the return on capital, but net investment will be used to determine the value of the company. (See Valuation section)

ii) The second adjustment to invested capital is to use inflation adjusted gross investment. This is done to get a real rate of return on capital and not a nominal rate of return on capital. Since cash flow and earnings are in today's dollars, it is necessary to adjust the gross investment into today's dollars that is carried on the balance sheet at historical costs. To clarify why this is important, consider a period of high inflation versus low inflation. A company's cash flow will be much higher during high inflationary periods compared to in low inflationary periods, but it is not attributable to real improvements in the business.

2) Cash Flow from Operations (CFO)

The second step in calculating CFIRR is to determine cash flow from operations. Cash flow from operations is the after tax cash flow accruing to capital providers in a given year. It's the amount of money management can spend on new projects, pay dividends, etc. By contrast, you can't spend earnings, and therefore, cash flow is a better measure of value. Since cash flow is not a GAAP term, there are variations on cash flow depending on the purpose. CFIRR uses the follow for Cash Flow:

Cash Flow from Operations =

+ Net Income

+ After-Tax Non-Operating Income / Expense

+ After-Tax Interest Expense

+ After-Tax Minority Interest

+ Depreciation and Amortization

It should be noted that CFO is a pre-interest measure of profitability to facilitate the comparison of firms with different degrees of leverage. Using post-interest measures of profit negates this and makes leveraged firms appear less profitable. Also, since interest is tax deductible, interest payments must be tax-effected when a post-tax measure of profits is used. CFIRR adds back after-tax interest expense. In other words, unleveraged firms do not get a tax shield from interest payments. Therefore, to compare operating profitability between leveraged firms and unleveraged firms, after tax-interest should be added back to net income. It follows that adding back after-tax non-operating income is also correct. In contrast, it is correct to add back pre-tax depreciation and amortization as both leveraged and unleveraged firms would get a tax shield.

3) Asset Life

The third step in calculating CFIRR is to determine the average asset life. This is the reverse of the straight-line depreciation equation. That is, asset life equals depreciating assets divided by depreciation expense. Specifically, CFIRR uses:

Asset Life = (Gross Plant + Other Non-Current Assets + Inventories) / Depreciation Expense

T

here is often confusion about the use of asset life in calculating a return on capital. It can appear that CFIRR is predicting level cash flows for the life of assets, however we are discussing performance measurement. At this point, CFIRR is simply calculating the rate of return subject to an asset life because different companies have different asset lives. For example, steel companies have much longer asset lives than software companies. CFIRR addresses the issue of asset life variance. This differentiates from traditional return on capital methodologies typically measured as ratios or effectively as perpetuities. Perpetuities are level cash flows forever.

Consider the following example (salvage value is excluded to isolate the importance of asset life):

| United Technologies | Adobe | |

| CF | $3,301 | $314 |

| Invested Capital | $23,842 | $1,199 |

| Asset Life | 24 | 6 |

| CFIRR | 13.10% | 14.70% |

| CF/Invested Capital | 13.80% | 26.20% |

If asset life were not incorporated into CFIRR, Adobe would look like a much better company. The ratio of CF / Invested Capital for Adobe is 26.2%, but since the asset life is only 6 years, the CFIRR return calculation is only 14%. On the other hand, United Technologies has a longer asset life and the difference between CFIRR and CF/Invested Capital is minimal.

4) Salvage Value

The fourth and final step in calculating CFIRR is to determine the salvage value. The salvage value is simply the net working capital. Specifically:

Salvage value is the only adjustment that improves the return on capital compared to traditional return on capital measures. It is an important adjustment for rapidly growing companies who often have large working capital balances just after large financings. By considering the working capital as salvage value, the CFIRR gives a more accurate calculation for return on deployed capital.

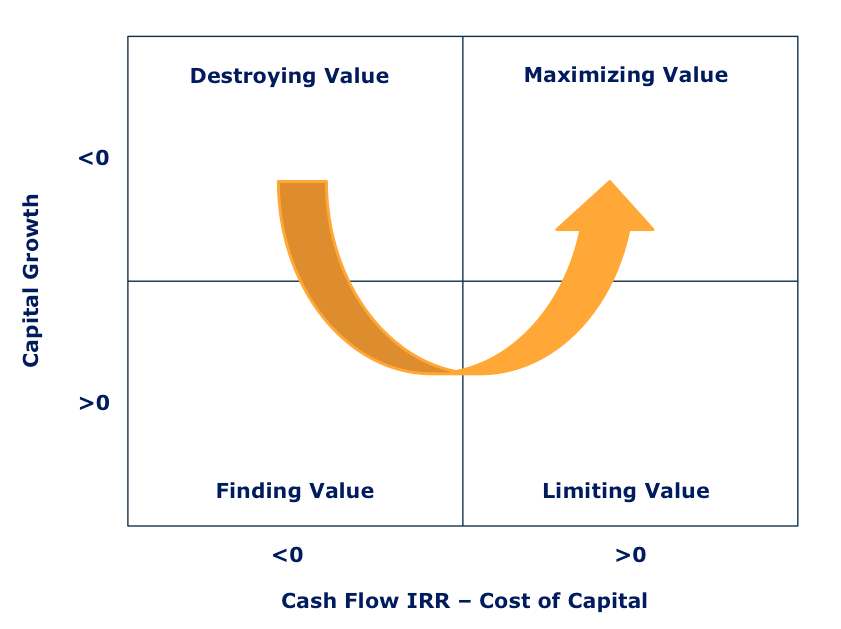

CFIRR, CAPITAL GROWTH AND THE COST OF CAPITAL

CFIRR on its own is a useful measure, but it is also important to understand the relationship to capital growth and the cost of capital.

The value creation grid is an effective way of describing this relationship:

Destroying Value

Companies that are growing their capital while earning a CFIRR below the Cost of Capital (COC) are destroying value. In general, the best strategy for companies in this quadrant is to sell off business units earning less than the COC. Start-up companies that are building their business are the exception to this rule. However, at some point companies must deliver a positive CFIRR – COC spread to maintain valuations.

Finding Value

Companies that are shrinking their capital while earning a CFIRR below the COC are finding value. In theory, companies in this quadrant are selling their under-performing business units and keeping their performing units.

Limiting Value

Companies that are shrinking their capital while earning a CFIRR above the COC are limiting value. In this quadrant, companies have good businesses but are not finding ways to make them grow.

Maximizing Value

Companies that are growing their capital while earning a CFIRR above the COC are maximizing value. Companies in this quadrant are the best companies. They have good businesses and they keep growing profitably.